Summary

Problem

Intuit’s invoicing system was outdated and rigid, causing cash flow delays and requiring users to adapt to complex accounting language. It lacked flexibility and mobile accessibility, making it inefficient for SMBs.

Solution

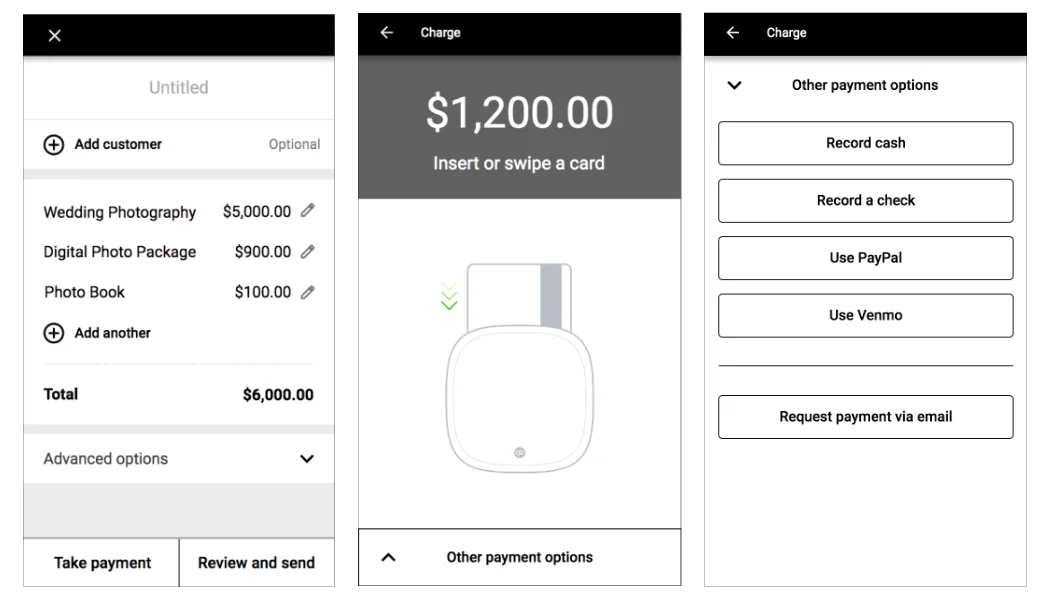

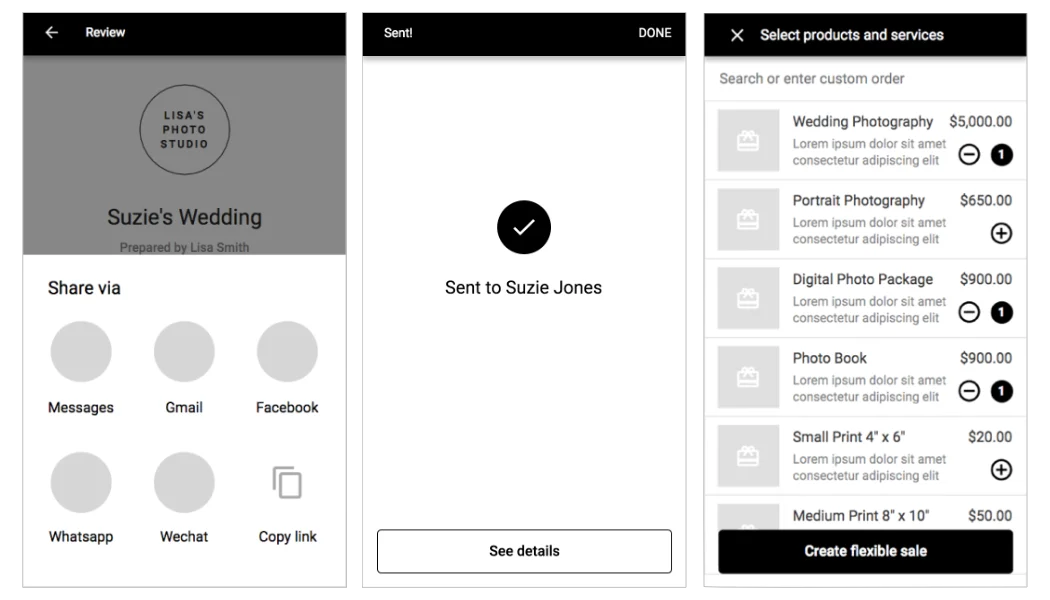

Intuit reimagined invoicing as part of an integrated “get-paid” experience, emphasizing a mobile-friendly, user-centered design that supports various payment types. This streamlined invoicing into a flexible tool accessible through QuickBooks Online.

Impact

The redesigned system increased QBO subscriptions by 43% in the U.S. and 63% internationally, with payment volume rising by 78%. User satisfaction improved, fostering stronger customer retention and loyalty.

Project Foundations

Overview

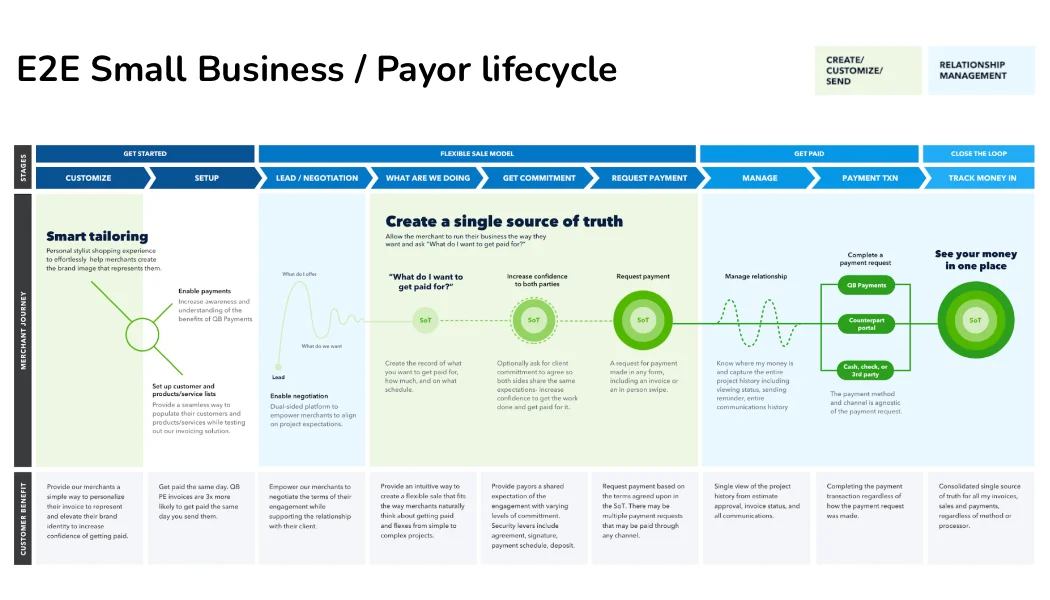

Intuit, a leader in financial software, aimed to transform its invoicing feature to align with the evolving digital needs of small and medium businesses (SMBs). This project was part of Intuit’s broader strategy to enhance the QuickBooks Online (QBO) experience, integrating invoicing with payments for a seamless “get-paid” journey. I led a multidisciplinary design team, working closely with product and engineering teams to bring this customer-centered vision to life.

Objectives

The primary goals were to modernize Intuit’s invoicing system to improve mobile usability, reduce delays in payment, and enhance flexibility for different types of transactions. The project aimed to empower SMBs by streamlining the invoicing process, reducing manual efforts, and supporting multiple payment methods, all while enabling business owners to retain control over customer interactions.

Team and Stakeholders

The project involved collaboration with a diverse set of stakeholders, including finance experts, UX designers, software engineers, and executive leadership. As the design director, I orchestrated efforts across teams, aligning project goals with business objectives and facilitating communication to ensure each phase was grounded in customer insights and technical feasibility.

Challenges & Barriers

Problem Statement

The existing invoicing system was outdated and rigid, failing to meet the mobile and customization needs of SMBs. This created friction in cash flow management and hindered the user experience, making it difficult for businesses to keep track of payments efficiently.

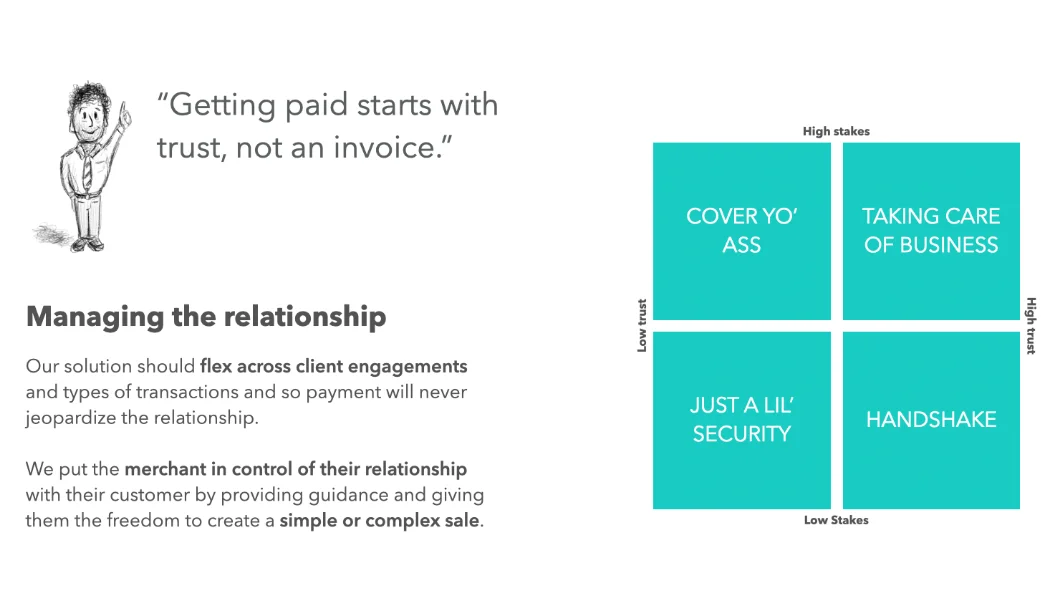

Complexity

Integrating a modernized invoicing solution into an established, legacy system was challenging. The design required flexibility to serve both simple transactions and complex sales, while balancing security, trust, and ease of use for various customer scenarios. Managing diverse technical dependencies across Intuit’s ecosystem added another layer of complexity to the project.

Risks

Transitioning users to a new system risked disrupting familiar workflows and required strong change management to gain user trust. Ensuring the solution’s reliability and simplicity for new users while accommodating experienced customers with advanced needs was critical to avoid customer attrition.

Market Dynamics

Customers

- Small and medium-sized businesses (SMBs) needing efficient cash flow management tools.

- High demand for flexible, mobile invoicing solutions that adapt to unique business needs.

- Expectation for an intuitive experience that simplifies payment tracking and enhances customer interactions.

Company

- Intuit sought to strengthen its competitive edge by addressing mobile needs and customer-centered design in financial solutions.

- This project aligned with Intuit’s commitment to providing tools that empower SMBs to manage their finances easily and efficiently, thus reinforcing the brand’s loyalty within the SMB sector.

Competitors

- Competing platforms like Square and PayPal were innovating with streamlined payment solutions, requiring Intuit to advance its invoicing and payments integration.

- Competitors were focusing on mobile-first experiences and simple, automated solutions; our approach differentiated by offering a tailored, relationship-centered approach that flexed to the business owner’s needs.

Strategic Leadership

Leadership Role

As a design leader, I established a strategic vision that emphasized user-centered design, cross-functional collaboration, and agile delivery. I drove alignment across product, engineering, and design, advocating for decisions rooted in customer insights, and ensured that every phase adhered to the project’s overarching mission of enhancing user satisfaction.

Key Decisions

We made key choices to prioritize a mobile-first approach and adopt flexible sales models that allowed users to create tailored invoices. Leveraging frameworks like the Kano Model, we focused on customer satisfaction and benefit mapping to ensure our solution resonated deeply with SMB needs.

Team Impact

I encouraged agile workflows and continuous feedback loops, enabling the team to iterate quickly and build confidence in the solution’s scalability. This approach not only improved the project’s outcome but also enhanced team members’ skills in fintech product development and cross-functional collaboration.

Method and Mastery of Craft

Design Process

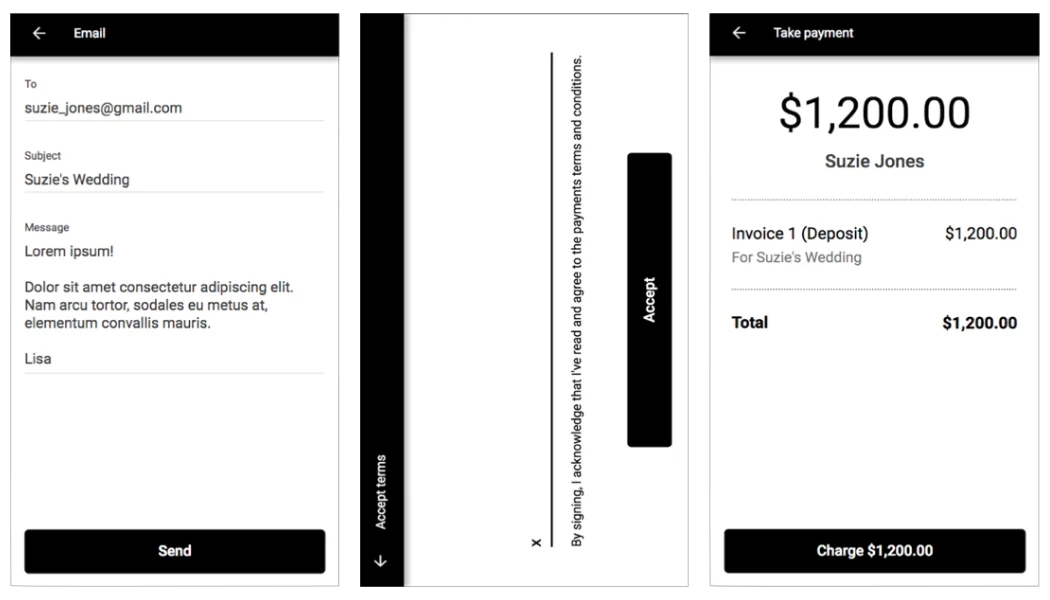

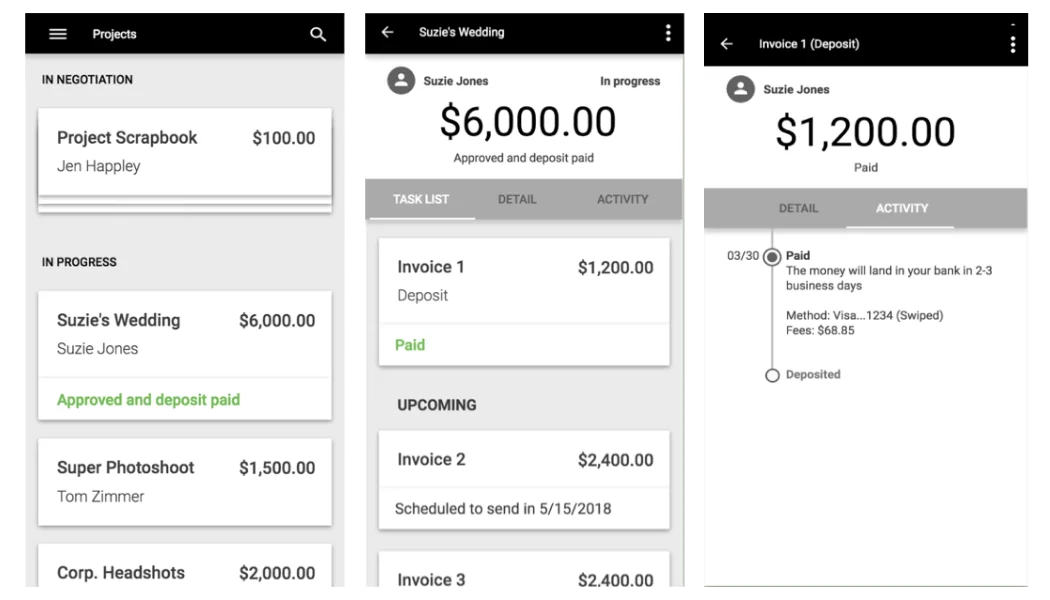

The team followed a user-centered design process, starting with extensive research to understand the pain points SMBs faced with traditional invoicing. Methods included in-depth interviews, “follow-me-home” studies, usability testing, and workshops like card sorting and affinity mapping. This helped shape a flexible invoicing model that adjusted to various business scenarios. We used rapid prototyping and iterative testing, refining the product at each stage based on real-time feedback.

User-Centric Approach

We placed users at the core of the redesign, ensuring that our solution addressed actual business needs and aligned with the ways SMBs naturally handle payments. By observing real users in their environments, we designed an intuitive invoicing experience that improved cash flow management and enhanced customer relationships, making it easier for SMBs to handle payments without becoming experts in accounting.

Iteration and Experimentation

Through frequent testing and iteration, we refined the invoicing process to ensure adaptability across different customer needs. From simple transactions to complex sales, we experimented with prototypes and made adjustments based on user interactions and feedback, ultimately building a product that felt accessible yet comprehensive.

Stakeholder Alignment

Cross-Functional Partnership

Collaboration was essential for this project’s success. I worked closely with product managers, engineering leads, and finance experts to align the invoicing system with Intuit’s broader business objectives. We held regular check-ins to keep all teams in sync, ensuring that the design choices and technical implementations were mutually supportive.

Communication and Alignment

To align stakeholders around our vision, we employed immersive techniques, including presenting data-driven narratives and interactive sessions where executives experienced the legacy system’s limitations firsthand. This approach helped secure buy-in and fostered empathy for the user challenges, facilitating smoother decision-making across teams.

Team Development

This project was a learning opportunity for the team, allowing members to deepen their understanding of fintech solutions and agile methodologies. Through hands-on experimentation and frequent user testing, team members developed stronger design and technical skills while learning to balance innovation with usability in a high-impact domain.

Outcomes & Insights

Results

The redesigned invoicing system delivered significant results, including a 43% increase in QBO subscribers in the U.S. and a 63% increase internationally. Payment volume rose by 78%, and e-invoice usage increased by 60%, indicating higher customer engagement and satisfaction with the modernized system.

Impact

This project set a new standard for user-centered financial tools within Intuit, highlighting the importance of adaptability and relationship-centered solutions. The success of the invoicing redesign contributed to long-term customer loyalty and retention, as businesses now had a more streamlined way to manage payments and improve cash flow.

Learnings

One key lesson was the importance of flexibility and simplicity in product design, particularly for SMB-focused tools. The experience reinforced the value of integrating user feedback continuously and demonstrated how strong cross-functional collaboration can drive both innovative and reliable solutions.

Impact

”QBO finally gets my business.

Invoicing Pilot ParticipantSmall Business Owner